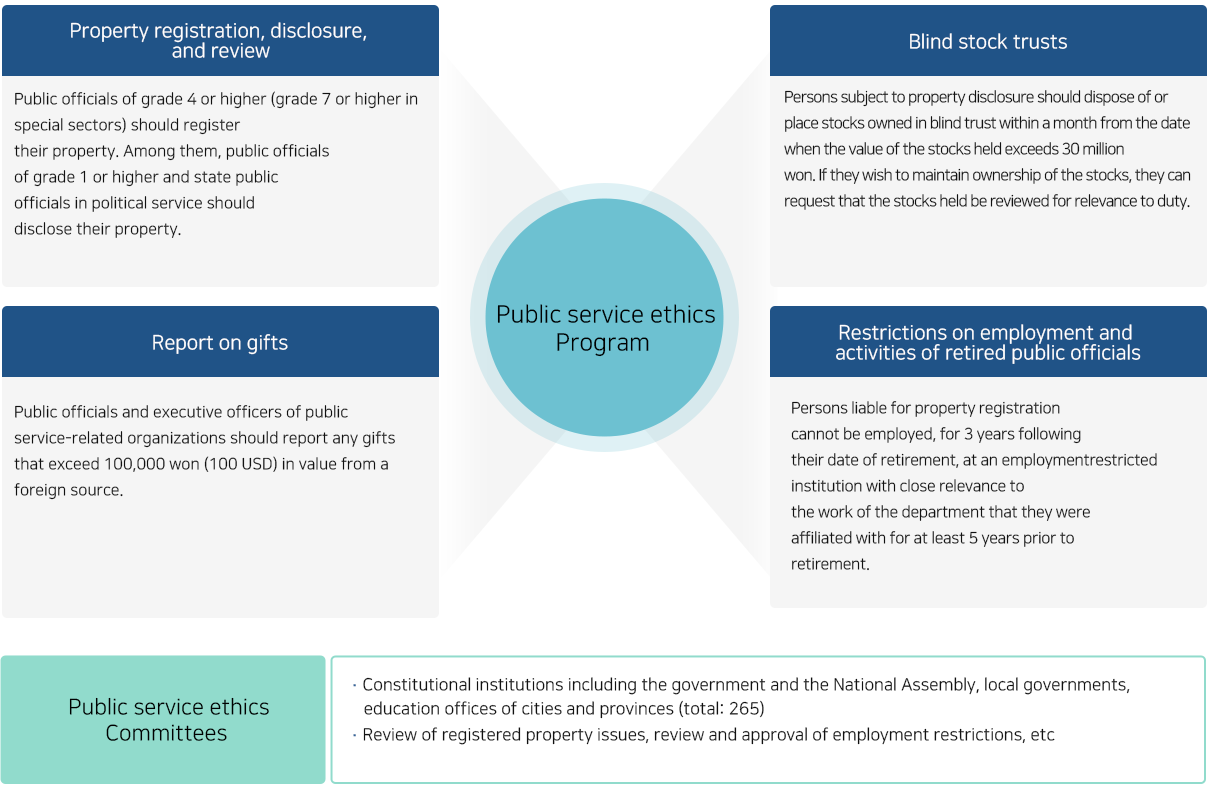

Public officials of a certain grade or higher as well as the their spouses and lineal ascendants and descendants are required

to register their property holdings,

and high-level public officials are subject to disclosure of registered property.

The public service ethics committee with

the jurisdiction over the public official concerned examines the propertyregistration and property acquisition process.

Persons Liable for Property Registration

Public officials liable for property registration include state public officials in political service, such as the President,

the Prime Minister, members of the State Council, members of the National Assembly, and public officials in political service

for local governments, such as the heads of local governments and members of local councils, public officials of grade 4 or

higher, superintendents of education, judges and public prosecutors, military officers of at least the rank of colonel,

and executive officers of public service-related organizations. In addition, public officials of grade 7 or higher in fields

with a probable conflict of interest in consideration of the characteristics of their duties, such as police, fire fighting, auditing,

tax,construction, civil engineering, food sanitation and accounting, officials of grade 2 or higher of the Financial Supervisory

Service,executive officials of grade 2 or higher of the Bank of Korea, Korea Deposit Insurance Corporation,

Korea Hydro & Nuclear Power and public service-related organizations must also register their property.

Property to be Registered

The property to be registered encompasses all property, including real estate (ownership of land and buildings, superficies,

and right of lease on a deposit basis pertaining to real estate, etc.) and movables (cash and deposits, securities, gold

and platinum, and memberships, etc.) owned by a person liable for registration, their spouse and lineal ascendants

and descendants. Lineal ascendants and descendants who are not dependants of the person liable for registration can

refuse to provide details of their property. This is only permitted if approved by the public service ethics committee with

appropriate jurisdiction to prevent intentional reduction or concealment of property, and the decision must be re-reviewed

every 3 years.

Registration Agencies, Timing and Method for Registration, etc.

The registration agency is the agency to which the person liable for registration of property is affiliated. Public officials who

work for ministries and administrations must register with the pertinent ministries and administrations, public officials

of local governments with pertinent local governments, members of the National Assembly with

the National Assembly Secretariat, and judges with the National Court Administration. However,

persons liable for registration of property who work for the government shall register their property with the Ministry of

Personnel Management. The registration should be submitted no later than the end of the month two months after

the date the official becomes liable for registration as a result of employment, promotion, transference, reassignment

or retirement. For regular reporting of changes, registration should be completed before the end of February

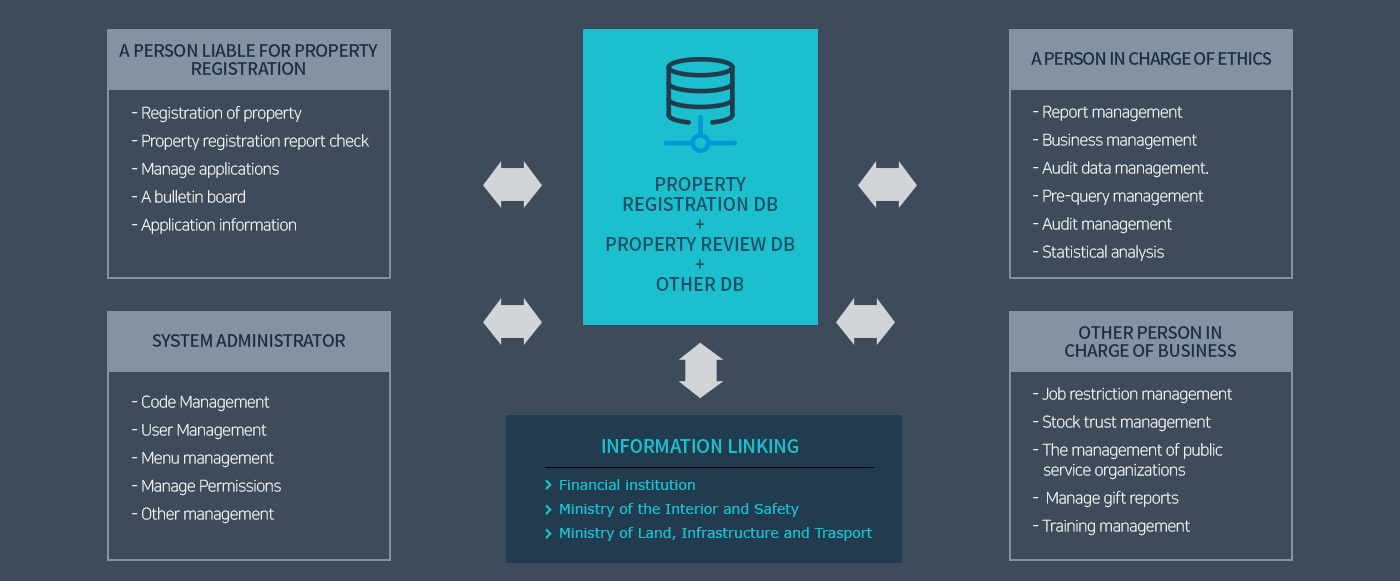

the following year. For property registration, persons liable for registration should access the Public Ethics and

Transparency Initiative(PEIT) System and report their current personal and family details, as well as property, online.

Persons Liable for Property Disclosure

Public officials liable for property disclosure include the President, ministers and vice ministers, state public officials

of grade 1 or higher, members of the National Assembly, heads of local governments, members of local councils,

superintendents of education, judges of at least the rank of chief judge in high courts, public prosecutors of

at least the rank of chief public prosecutor in the Supreme Prosecutors’ Office, heads of relevant public service-related

organizations, and heads, deputy directors and standing auditors of public enterprises. Reports concerning property

must be released publicly at the time of candidacy registration for persons who wish to become candidates fo

President, members of the National Assembly, heads of local government or members of local councils;

at the time of submission of the proposal of approval for appointment for the Chief Justice of the Supreme Court,

President of the Constitutional Court, and Prime Minister whose appointment requires the approval of

the National Assembly; and at the time of submission of the proposal of election for public officials, such as

Judges of the Constitutional Court who are elected by the National Assembly.

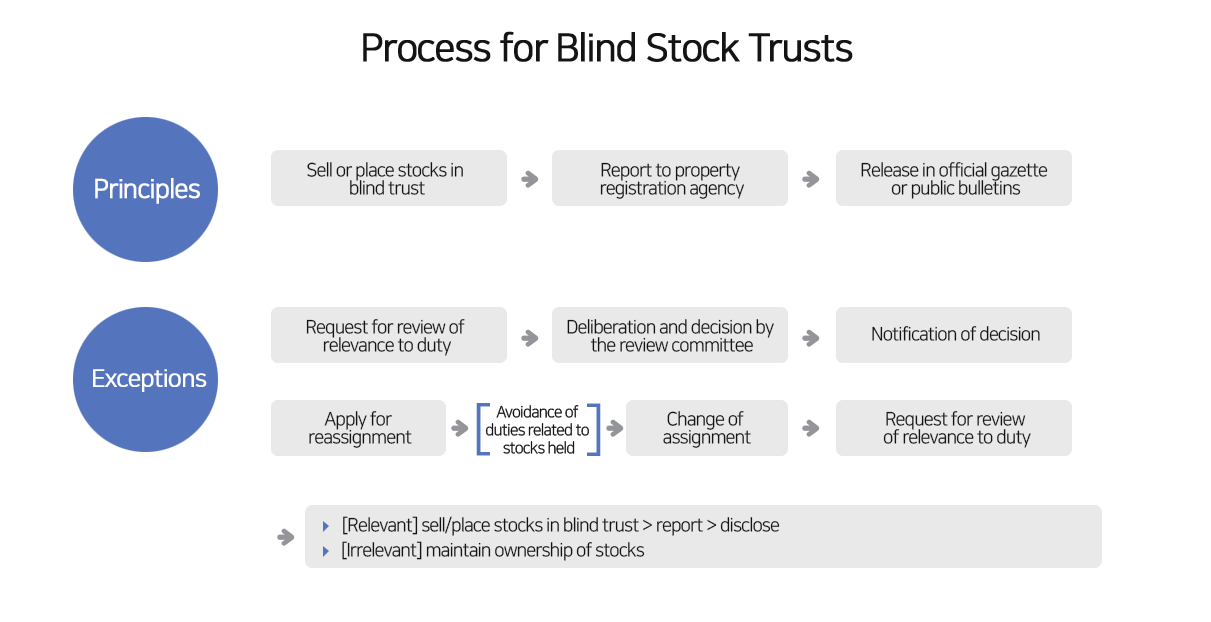

Disclosure Agencies, Timing and Method of Disclosure, etc.

The public service ethics committee shall disclose to the public registered details and any changes

concerning the property of persons liable for registration under its jurisdiction, as well as the property of

their spouses, lineal ascendants and descendants within one month after the time limit for registration

in the official gazette or public bulletins.

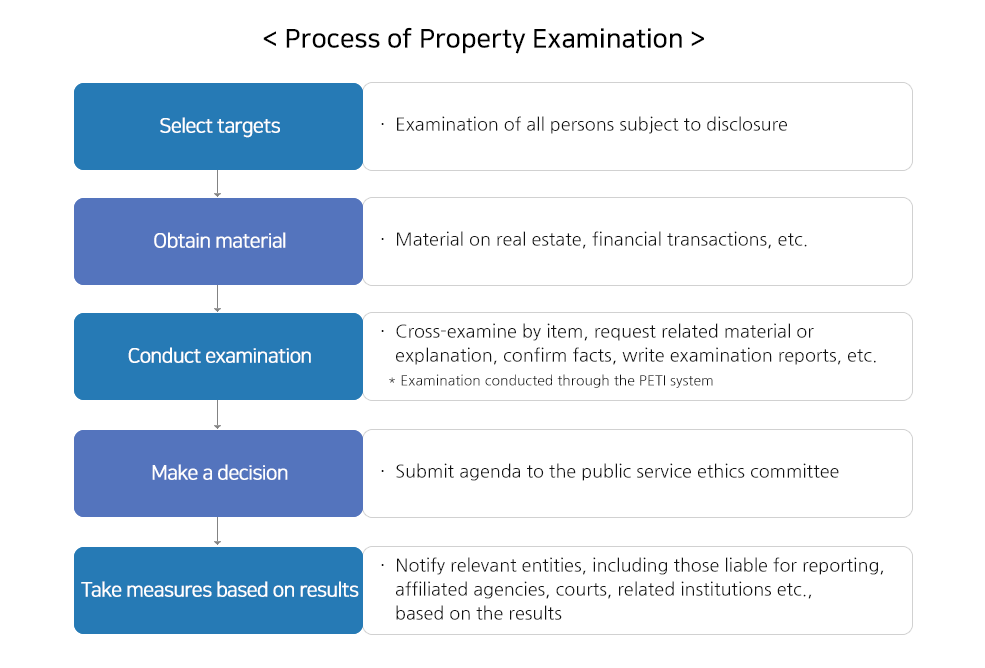

Review Agencies and Review of Registered Details

A public service ethics committee reviews the registered details of persons liable for property registration.

The review includes a review of truthful registration, including false or erroneous reporting of property,

and a review of the process of property acquisition, such as the background and income sources for

property acquisition.A public service ethics committee must complete the review of all public

officials subject to disclosure of property within three months. Where deemed necessary,

the period of review may be extended by up to three months by a resolution of the public service ethics committee.

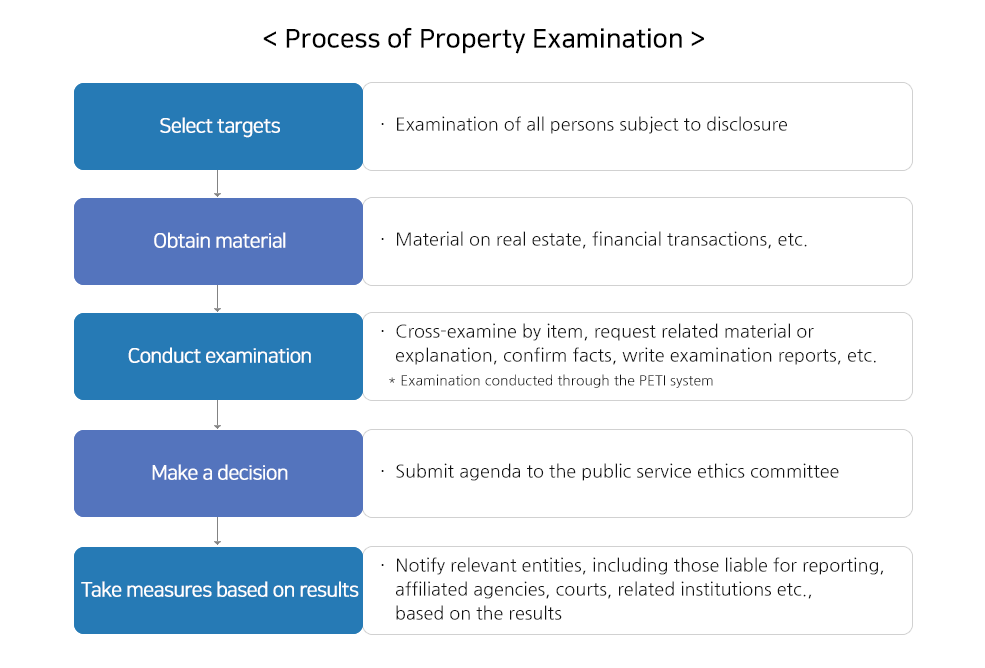

Necessary Measures and Procedures for Property Review

A public service ethics committee can order persons liable for registration to provide additional

documentation related to the property registration for the review if necessary. Furthermore,

it can request a report or material necessary for the review from relevant institutions or organizations.

In this case, heads of such institutions or organizations cannot refuse to submit the requested report

or material. A public service ethics committee can also demand attendance of any person liable for registration

and concerned persons in matters of property registration and ask those persons to make statements.

Meanwhile, a public service ethics committee must request the Minister of Justice or the Minister

National Defense (in case of military personnel or civilian employees of the military) to investigate persons

liable for registration who are suspected to have filed a false registration or to have acquired benefits with

confidential information acquired while performing an official duty. The review report is written based

on the results of this process and approved by the public service ethics committee. Notification of the result

is provided to the individual and relevant institutions, including the organization to which the person subject

to the inspection belongs and the court.

Implications

By requiring public officials who are likely to face a conflict of public and private

interests given the nature of their position and duty to register their property and

reviewing the reported details, unfair acquisition of property can be prevented.

Furthermore, the process helps to improve the transparency of property holdings

by public officials and the fairness of the policy-making process by enabling the

supervision of the media and citizens over the property holdings of high-level public

officials.